(pexels.com)

As curiosity kicks in (maybe a little late though, but never too late), we’ve tried to decipher, and hopefully, in a simple way, the key things we need to understand about a cryptocurrency.

Virtual currencies or cryptocurrencies are digital mediums of exchange to trade created by groups or individuals.

Since governments don’t regulate most cryptocurrencies, they are an alternative means of exchange outside the state monetary policy.

Bitcoin is the major cryptocurrency with first-wide applications.

However, there are many digital coins, with more coming up each month. Collectively, non-bitcoin cryptocurrencies are called altcoins to distinguish them.

A Brief History Of Cryptocurrency

The story of the virtual coins began with David Chaum. The Americans developed the system called eCash and later the DigiCash that made economic transactions confidential using cryptography. However, the term cryptocurrency was first used in 1998 when Wei Dai thought about a new payment method with a cryptographic system.

Satoshi Nakamoto: First Cryptocurrency

Satoshi Nakamoto

In 2008 during the funding crisis, the coins were fast losing value. In 2009, Satoshi Nakamoto created Bitcoin as the first cryptocurrency.

Many assume Satoshi Nakamoto to be a pseudonym.

The reason was to develop a way of payment to be used internationally without the control of financial institutions. The inspirations were the global financial crisis and the need to see a form of money different from the conventional form.

The Popular Types of Cryptocurrencies

Although Ethereum and Bitcoin dominate cryptocurrency investments, there are over 1,500 cryptocurrencies. This is due to the highly competitive market, making most currencies not gain traction.

According to Coinbase, below are the top-performing cryptocurrencies in 2021.

Bitcoin, unsplash.com

Market cap: Over $820 billion

BTC is the original cryptocurrency created in 2009.

It runs on a ledger logging blockchain transactions that are distributed in a network of computers. Due to the addition of distributed ledgers, it must be verified by solving cryptographic puzzles.

As of 22nd October 2021, the price was $61,182.81.

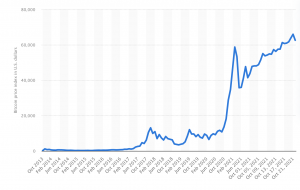

The performance of BTC over the years can be illustrated in the graph below.

Bitcoin cryptocurrency performance chart, statista.com

(ethereum.org)

Market Cap: Over $354 billion

Ethereum is a popular program to developers as a blockchain and cryptocurrency platform due to its applications like smart contracts that execute automatically on certain conditions.

Ethereum has experienced growth in five years, from $11 to about 3,000 by the end of September 2021.

Tether (USDT)

Market cap: Over $68 billion

Unlike other cryptocurrencies, Tether is a stablecoin backed by fiat money such as the euro and the US dollar. It hypothetically retains its value similar to one of these currencies. In theory, this means Tether’s value is stable unlike other cryptocurrencies, and favored by investors wary of extreme volatility.

Market cap: Over $68 billion

Somehow new to the crypto scene, Cardano is famous for its embrace of proof-of-stake validation.

The method expedites the transaction period and reduces environmental impact and energy usage. It eliminates problem-solving and competitive aspects of verification in other platforms like Bitcoin.

Also, it works like Ethereum as it enables decentralized applications and intelligent contracts powered by its native coin, ADA.

Compared to other crypto coins, it has modest growth. In 2007 the price of ADA was $0.02, while by the end of September 2001, it was $2.10.

Binance Coin (BNB)

(binance.com)

Market cap: over $65 billion

With Binance Coin, you can pay fees and trade on Binance.

Since its launch in 2017, the coin has grown by facilitating transactions on the Binance exchange platform. Today, you can use it for payment processing, trading, or booking travel arrangements. You can also trade for other cryptocurrencies like Bitcoin and Ethereum.

In 2017, its price was $0.10, and by 30th September, it had grown to over $382.

Market cap: over $45 billion

It was created by the founders of Ripple, a payment processing and digital technology company. XRP is used on the network for exchanges of various currency types, including other major cryptocurrencies and fiat currencies.

In early 2017, the price was $0.006. As of 30th September 2021, it was $0.94.

Market cap: Over $41 billion

It was developed to power decentralized finance uses, intelligent contracts, and decentralized apps (DApps). It runs on unique proof–of–history and proof-of-stake mechanisms to help process transactions securely and quickly. Solana’s native SOL powers the platform.

It was launched in 2020 when the SOL price was $0.77, and by the end of August was almost $140.

Market Cap: Over $31 billion

Like Tether, USDC is a stablecoin backed by the US dollar aiming for a 1 USDC to 1 USD ratio. Powered by Ethereum, you can complete global transactions using USD.

Market cap: Over $28 billion

Cryptocurrencies can use numerous blockchains. Polkadot integrates them through a crypto network connecting various blockchains to work together. The integration might change cryptocurrencies’ management leading to the high growth of Polkadot since its launch in 2020.

During the launch, its price was $2.93, and by 30 Sept 2021 was 25.61.

(dogecoin.com)

Market cap: Over $26 billion

Famously started in 2013, it has become a prominent crypto option due to the creative memes and dedicated community. Unlike other cryptos like Bitcoin, there’s no limit to the creation of Degocoins, making it susceptible to devaluation when supply increases.

In 2017, Degocoin’s price was $0.0002, and by September 30th, it was $0.2.

The Use Of Cryptocurrencies

(pexels.com)

Cryptocurrencies have grown in past years due to individuals seeking digital assets as alternative capital.

However, below are other uses of cryptocurrencies across different domains.

Money Transfer Via Cryptocurrency

Receiving and making payments at high speed and low cost is a popular application of cryptocurrencies. It is due to venture capital funds, institutional investors, fintech in digital currencies, and distributed ledger technology.

Crypto payments are peer–to–peer (P2P) since users can send and receive payments instantly worldwide without approvals from external sources. Moreover, there are no banking, returned deposits, or overdraft charges.

Store of Wealth

Unlike cash, digital currencies like crypto are a secure alternative way to store wealth that is censorship-resistant. It means that only people with private keys can access the wallets, unlike traditional banks, which are vulnerable to thefts, hacks, and malpractices. Therefore, personal digital wallets can’t be frozen by governments or authorities.

Decorrupting Charities

The donations to charities based on crypto are transparent, cost-effective, and faster than conventional currencies. It is because Blockchain, the underlying technology, enables the transparent flow of information. Besides, cryptocurrency donations send more cash to NGOs as it also facilitates anonymous contributions.

Gaming

Today, crypto-based games are popular since they solve some fraud and transaction problems that players and game developers encounter. Crypto games offer decentralized and streamlined payments that provide ownership to players and encourage more purchases through easy transfers from the games.

Some land-based casinos also use crypto and offer players tokens as a reward for playing.

How to Buy Cryptocurrency?

(pexels.com)

When new to crypto, buying digital coins can seem challenging. Thankfully you can follow the easy steps below.

Choose Crypto Exchange Or Broker

To buy cryptocurrency, you first need a crypto exchange or broker.

A crypto exchange is a platform for sellers and buyers to trade cryptocurrencies. Exchanges charge low fees but have a complex interface, advanced performance charts, and multiple trade types that make them intimidating to new investors.

The common exchanges are Coinbase, Binance.US, and Gemini.

Brokers eliminate the complexities to offer user-friendly interfaces. Some charge higher fees compared to exchanges.

Create And Verify An Account

When you decide on an exchange or broker, you can open up an account. You may need to verify your identity depending on the amount you want to buy and the platform. It’s an essential step against fraud and to meet the federal regulatory requirements.

Without completing the verification process, you may not sell or buy. The platform asks for a copy of your passport or driver’s license. To prove your identity, you upload a selfie.

Money To Invest In Cryptocurrency

To buy crypto, ensure you deposit funds in the account. To deposit, you can link your crypto account to your bank account and authorize a wire transfer or make payments with a credit or debit card. Depending on the broker or exchange and the funding method, you might wait a few days to use the money to buy crypto.

Place Order

Once you have money in the account, you can place the first currency order. When you decide on the currency to buy, enter its symbol, for instance, BTC for Bitcoin, and the number of coins to purchase.

Select Storage Method

Since crypto exchanges lack protection, they risk hacking or theft. Therefore, you need secure storage to place the cryptocurrencies. If buying through brokers, you have little choice in your storage, but you have more options that include hot and cold wallets with an exchange.

Conclusion Of The Cryptocurrency Guide

Investing in cryptocurrency is speculative, and you should commit funds you are comfortable losing. At times, the crypto assets fluctuate significantly due to intense volatility.

Also, investors can trade against sophisticated investors making the experience challenging for new players.

People Also Read:

See Who’s Invested In Cryptocurrencies!